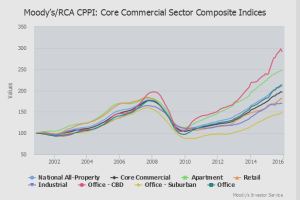

Commercial real estate had a banner year in 2015, and the fundamentals of high demand and low vacancies are still driving rents higher. There is, however, a catch that could cool the market quickly, at least when it comes to financing. Investors are insisting on high yield, and the bonds backing commercial mortgages are not giving them that, so they are moving on to other products, leaving a big crack in commercial financing.

“I think cracks is a little bit of an understatement for where the market has been for January and February, where, for all practical purposes, the market was frozen,” said Willy Walker, chairman and CEO of Walker & Dunlop, a real estate finance firm.

Commercial real estate, which includes apartments, shopping malls, offices and warehouses, are backed by nearly $3 trillion in mortgages, according to the Mortgage Bankers Association (MBA). The lenders include big banks, which are the largest, insurance companies and commercial mortgage backed securities (CMBS), which are bonds sold to investors. That last one is where the problem lies. It is the second-largest source of commercial real estate debt, and during the last boom, back in 2005, CMBS was very popular.

CMBS tends to have a 10-year life span, at which point the debt matures and real estate owners have to refinance the loans. These maturities are expected to surpass $400 billion annually this year and in 2017, according to CBRE, a real estate services firm. That is $100 billion more than last year. CBRE “conservatively” estimates that 18 percent of loans this year and 29 percent of loans next year could have problems refinancing, due to lack of investor demand for the bonds. This translates into about $43 billion in potentially troubled loans over these two years.

“We think some of these are going to be remonetized through asset sales, but some will certainly hit the foreclosure list and end up on the special services list of loans to be worked out,” said Brian Stoffers, who oversees the debt and structured finance practice at CBRE.

View entie article here at CNBC.COM

If you would like to find out more about commercial real estate financing contact us at Liberty Realty Capital Group.