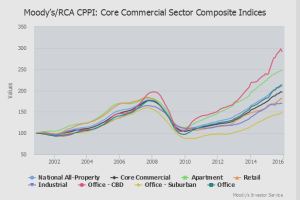

Nothing lasts forever, least of all increasing valuations on commercial properties. The most recent Commercial Property Price Indices (CPPI) released by ratings firm Moody’s and research firm Real Capital Analytics (RCA) show that the all-property composite index remained flat in December. There was even a slight (0.3 percent) decrease in prices reflected in the core commercial index. Moody’s/RCA researchers note that this was the lowest the indices have dipped since the market recovery got underway.

In fact, only apartment properties and suburban office buildings continued to see rising prices in December, with indices for those property types rising by 0.8 percent and 1.6 percent respectively. The rest of the core property types experienced price decreases.

The price index for office buildings in Central Business Districts (CBDs) declined the most, by 2.1 percent, followed by index for office properties overall, which declined by 0.4 percent. The indices for retail and industrial properties both showed decreases of 0.2 percent.

According to a recent note from RCA, cap rates on commercial assets have also showed little movement in January and February.

Read entire article in National Real Estate Investor.

To discuss commercial mortgage financing needs contact Liberty Realty Capital.